Supply and Demand Imbalance: Essential Housing Opportunities

By Clay Grubb, CEO

“The future is disorder. … It’s the best possible time to be alive, when almost everything you thought you knew is wrong.”

Tom Stoppard, Arcadia

September 30, 2023

Dear investors,

Despite the headwinds faced in housing due to the dramatic increase in interest rates, I am proud to share that Grubb Properties’ stabilized Link Apartments℠ continued their positive trend with year-over-year revenue growth in the third quarter.

Despite a small drop in net operating income, our overall results continue to exceed the national averages. According to Yardi, the national total operating expense increased 8.5% from July 2022 to July 2023. One of the biggest drivers of surging costs was insurance, with many communities – particularly those in Florida and Texas – experiencing significant spikes due to rising hurricane and flood risks. These markets are also seeing the greatest downward pressure on rents due to a significant escalation in construction during the COVID pandemic. As you know, we put our greatest emphasis the past couple of years on acquisitions in New York and California. These markets for many reasons are now witnessing some of the greatest rent increases in the country.

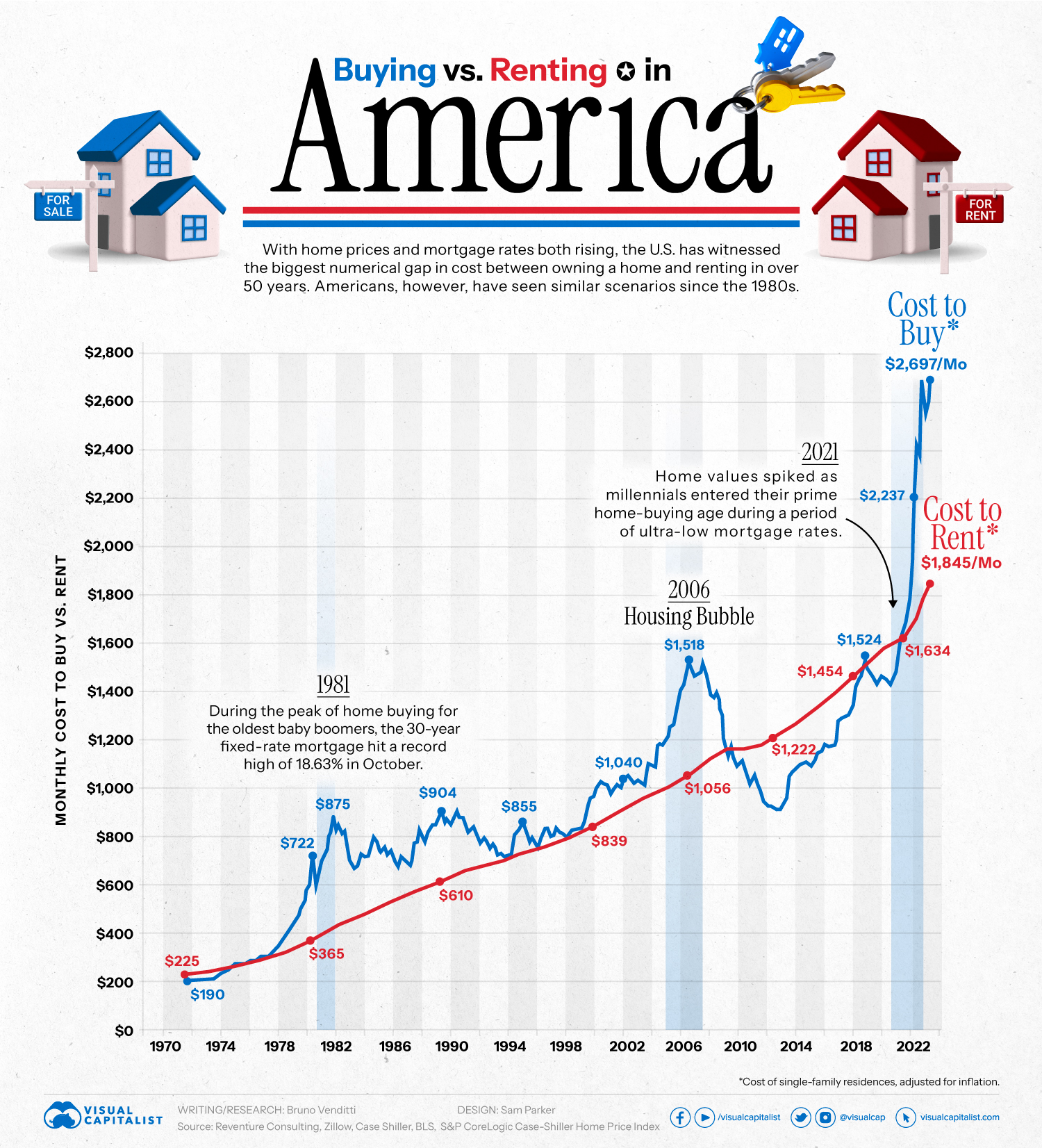

Currently, the housing market is in a place of economic disorder and confusion. The dramatic surge in interest rates, driven by the Federal Reserve’s inflation concerns, has caused the cost of homeownership to almost double. As you can see in the graph below, the monthly cost of homeownership for a new buyer of the median US home has jumped to $2,697/month from less than $1,500/month in approximately 18 months. History suggests this should result in an immediate drop in home prices by close to 40%, solving the Federal Reserve’s shelter inflation concerns. Yet that is not occurring, and Fed policymakers find themselves in a quandary. Why isn’t inflation abating?

The answer lies in the most fundamental concept of Economics 101: the laws of supply and demand. At a time when millennials, the largest generation in U.S. history, are reaching the age of peak household formation, America is facing its greatest shortage of homes since World War II.

We have more 31-year-olds in America than ever, but we have more 16-year-olds than 31-year-olds. These large generations are driving demand for housing – but there is little inventory of available homes for them to buy. According to economist Mark Vitner, in his presentation for our annual investor meeting in September, 60 percent of current homeowners with mortgages have a rate below 4.0% and 80 percent have rates below 5.0%. Surprisingly, according to the National Mortgage Database, 42% of Americans own their homes outright without a mortgage. Given that a new mortgage rate currently averages more than 8.0%, homeowners have little economic incentive to sell. At the same time, high interest rates are hampering construction of new homes, with multifamily starts down 31.5% according to RealPage Analytics. This is on top of 2010-2019 being the decade with the lowest amount of new apartment construction of any decade in over 50 years, which has resulted in America’s affordable housing crisis.

With the burgeoning demand for housing well outpacing this severely constrained supply, housing prices are not declining despite the Fed’s actions. People must live somewhere. If we do not dramatically increase construction of new housing, we will witness significant housing inflation no matter what the level of mortgage and interest rates. Housing makes up over one-third of the Fed’s preferred inflation gauge. With each rate increase, the central bank makes it significantly harder for new developments to make economic sense, thereby making housing scarcer. However, they struggle to dull the demand because of our demographic makeup. Sadly, I have little faith that the Federal Reserve has any appreciation for its role in creating what may be the greatest source of inflation over the next decade: the elimination of our housing supply chain that extends into labor, resources, and economic stability. While this is sad for the average American, it should result in significant value appreciation for our Link Apartments℠ portfolio over the next decade.

Today, the cost of homeownership for a new homebuyer is $900/month more than renting, which is over $10,000 annually and a 46% annual premium. We reached an equivalent peak right before the Global Financial Crisis, a time when we had significant fraud in the system. At that point in time, many Americans had jumped into the house- and condo-flipping business with some appraisers cooking books and rating agencies granting AAA ratings for mortgage securities portfolios that were complete junk. We had a glut of homes and it seemed as if anyone with a credit card could secure multiple mortgages through a no-doc approval process. We now have the exact opposite situation. The federal government swept in reforms on the mortgage approval process that have proven to be completely draconian to the average hardworking American, cutting millions out of homeownership programs.

With limited access to financing for both developers and potential buyers of homes, we find ourselves in a situation where development is too expensive to justify in all but a few limited markets. After the Global Financial Crisis, it took the country 10 years to get back to the 50-year average production of new houses during a time when household formations were the greatest in that 50-year period. If the Federal Reserve breaks the back of the housing industry, we will see unfortunate and unconscionable homelessness and record inflation for many years to come. A significant drop in new construction will likely result in a dramatic spike in apartment and home rental rates. The result will be a great boon for those with ownership in homes and apartments, as the cost of new entry is going to rise significantly.

It is our belief that we are at or close to the bottom for property values for this cycle. That does not mean that pain will not increase. History has shown repeatedly that more businesses go bankrupt coming out of a recession than during one because owners deplete their resources and energy during the recession. To avoid this trap, we work hard to get the bad news behind us quickly. Therefore, during the third quarter, we revalued a supermajority of our portfolio. We believe these new valuations reflect the low point for the portfolio.

It has been a challenging 21 months since the start of 2022, but I am confident the majority of our news going forward will be more positive despite the Federal Reserve’s best efforts to ruin the party.

Sincerely,

Clay Grubb, CEO

Click here to get more information about investment opportunities with Grubb Properties.

______________

The information and opinions contained in this letter are general in nature and apply to the Link Apartments℠ portfolio as a whole and are not intended, and should not be construed, to apply to the specific portfolio of any particular investment fund managed by Grubb Fund Management, LLC (which may or may not contain Link Apartments℠ assets). In considering their investment in a particular investment fund, investors should not rely on the information and opinions contained in this letter but should carefully review the financial statements and quarterly and other investor reports provided by Grubb Fund Management, LLC for that specific investment fund.

Clay Grubb

Chief Executive Officer of Grubb Properties

|

|